About The Offering

Capturing assets that are too big for regular investors and too small for publicly traded companies

Invest in established, profitable oilfields in basins that public companies ignore

- Assets located in Fort Worth Basin

- Oil decline rates are flat and predictable

- Having produced since 1920’s, information available is extensive

- Diversified commodity base

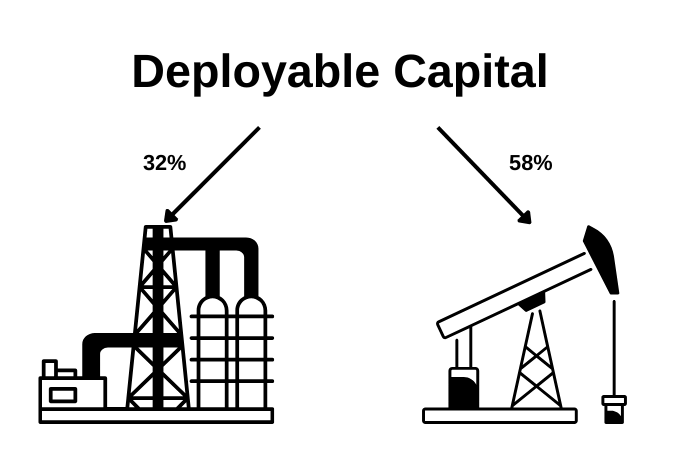

Capital deployment with two tiers for a balanced risk profile

- Acquire proven, producing oilfield Unit with known & immediate cash flow in Jack County, Texas, limiting overall fund downside and further develop the Unit with in-fill wells

- Drill new undeveloped acreage position with large upside opportunity in King County, Texas

Customers served!

1 %Targeted Pre-Tax IRR

Customers served!

1 XTargeted Pre-Tax MOIC

Customers served!

$ 1 MRaise Amount

Customers served!

$ 1 MClass B Per Unit Size

Investment Highlights

Tax Benefits of Oil and Gas Investing

- Oil and Gas investments offer tremendous tax benefits relative to other investment asset classes due to the U.S Tax Code Intangible Drilling Cost deduction*

- U.S Tax Code also enables an accelerated 5-year tangible deprecation deduction

- Fund offers election to be either a General or Limited Partner during the drilling phase to maximize tax benefits

Track Record

- 30+ years of investing in and operating oil and gas assets (through its affiliates)

- Proven experience with Joint Venture partnerships averaging double digit returns net-of-fees

- A Management Team with a combined 100+ years of oil and gas experience

Pecos Valley Advantage

- Fully integrated management team with affiliated operating company to maximize results

- History managing assets in multiple basins, including previous successful drilling ventures in Fort Worth Basin